3 must-read oil and gas outlook reports

A pick of the best insight reports to help you get ahead of the market

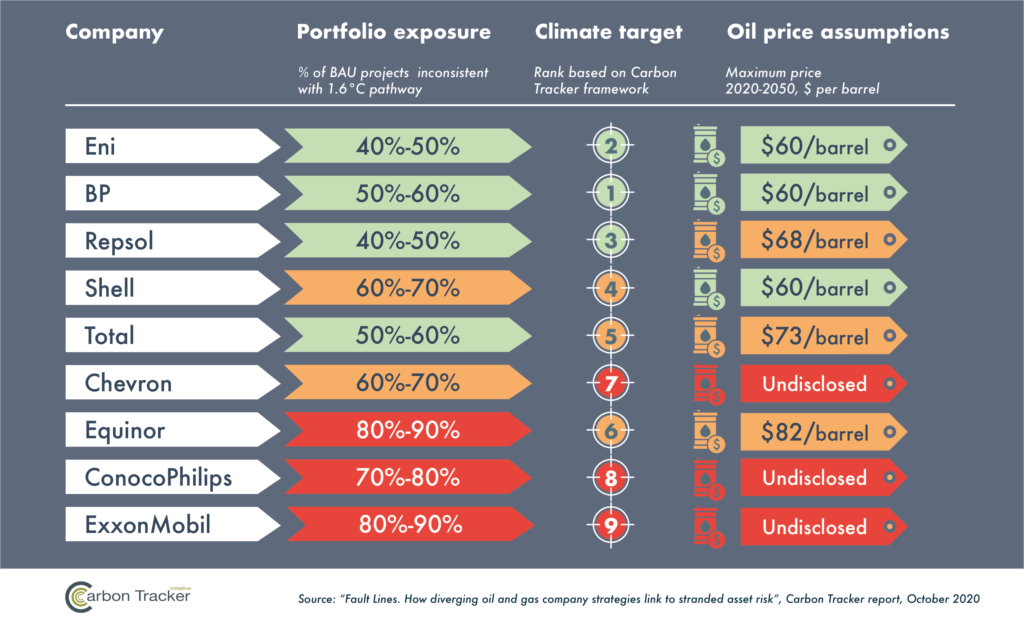

Carbon Tracker’s Fault Lines: How diverging oil and gas company strategies link to stranded asset risk

https://carbontracker.org/reports/fault-lines-stranded-asset/

Carbon Tracker’s report is essential to understanding the future of investing in oil and gas. It’s a deep dive into global capital expenditure on projects that could result in stranded assets in a net-zero carbon world; taking a magnifying glass to the world’s biggest fossil fuel producers, it situates the companies’ portfolios, emission goals and impairment price assumptions in relation to overall climate targets.

The report spotlights “the 15 largest projects that were sanctioned in 2019 and don’t fit in the International Energy Agency’s 1.65-1.8˚C Sustainable Development Scenario (SDS) on the basis of production costs, even assuming a margin of error.” In total, the projects amount to $60bn in associated capital expenditures between now and 2030. Carbon Tracker’s analysis provides an understanding of where different oil majors stand, and where they’re diverging in strategy.

The International Energy Agency’s World Energy Outlook 2020

https://www.iea.org/reports/world-energy-outlook-2020

2020’s World Energy Outlook is unprecedented – to match an unprecedented year – in that it focuses specifically on short and medium-term impacts of the pandemic, particularly for the next 10 years. In order to dive into the details of potential futures following COVID-19, the outlook has illustrated four scenarios that control for the most important unknowns. These variables include the duration of the pandemic and how long it will take to return to pre-crisis conditions, the resulting demands for energy, potential policy shifts, and 2050 net-zero emissions goals. All of these scenarios envision a rapid growth in renewable energy, but point out that the pandemic has made vulnerable the power infrastructure of many countries, especially developing economies. While renewables trend steadily upwards, the fate of gas production varies significantly between scenarios. The IEA additionally offers, alongside these detailed pathway projections, a Sustainable Recovery Plan that outlines a path to 4.5 billion tonnes fewer emissions by 2023 – the two reports are worth reading in conjunction.

Production Gap’s 2020 report

https://productiongap.org/2020report/

If your goal is a big-picture understanding of where the oil and gas industry stands in terms of pathways to 1.5 or 2 degree global warming limits, this is the report you’re looking for. The Production Gap report is released annually by a team of research partners from independent think tanks across Europe, in collaboration with the UN Environment Programme. One of the team’s key findings in the 2020 report is that the oil and gas industry would need to decrease production by around 6% annually to feasibly limit global warming to 1.5 degrees – but instead, Production Gap estimates a 2% annual increase.

Where Carbon Tracker focused on company-specific analysis, Production Gap conducts analysis by country, outlining the facts and figures necessary to understand how specific nations and regions are expected to perform in terms of fossil fuel production, how different governments have subsidized fossil fuel expansion, and what steps can be taken to course-correct and align with Paris agreement goals. With an international eye for impacts of the pandemic and far-reaching consequences of production decisions happening today, the report helps the industry understand where it is, and where it needs to be.