Should UK standing charges be abolished?

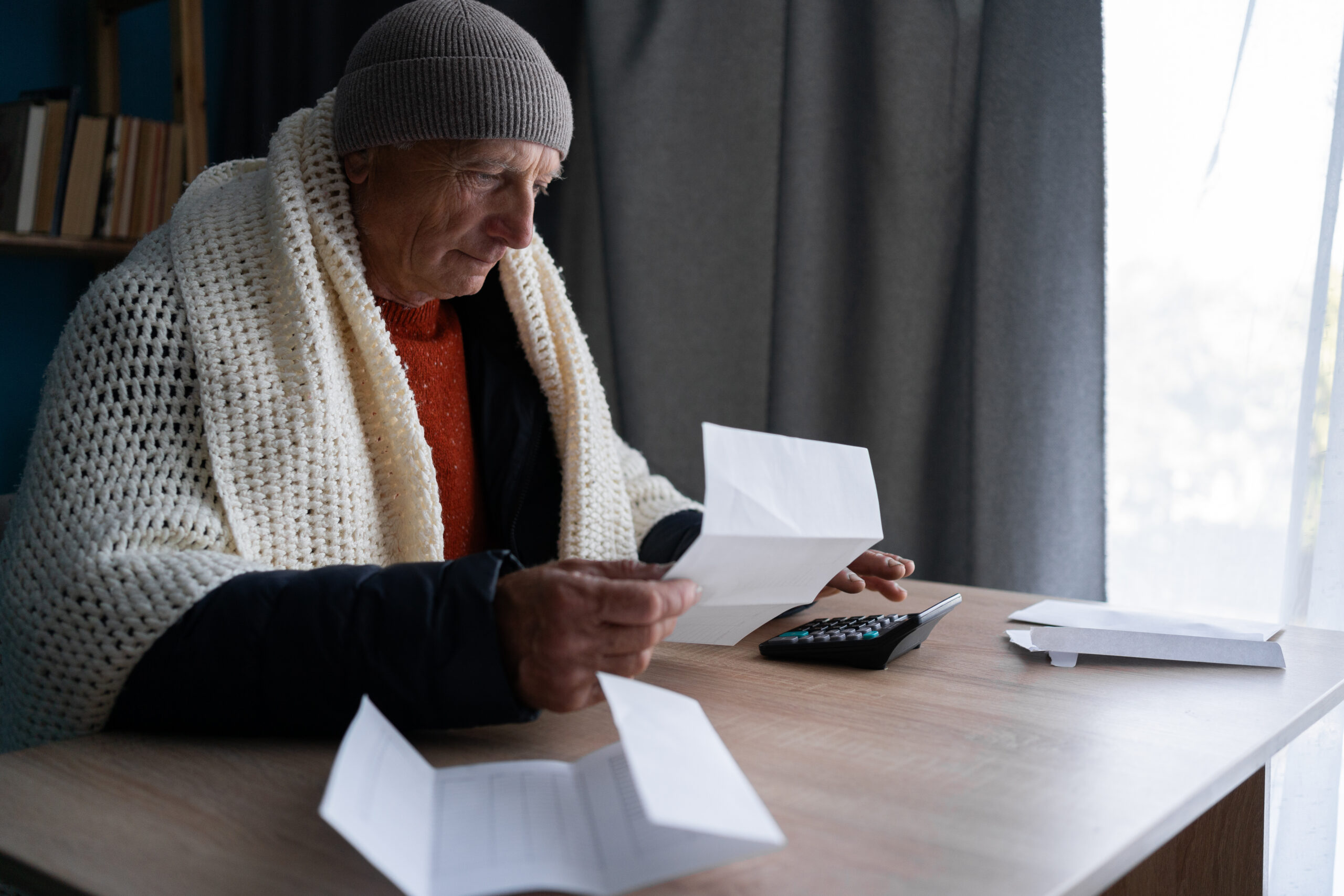

Customers incur standing charges even if they do not use any energy, which penalises low-income families and those who consume significantly less than average.

UK standing charges were brought in a decade ago by the-then Prime Minister, David Cameron, as a way to simplify energy price tariffs. Typically, they cover distribution costs. However, customers incur the standing charge even if they do not use any energy, which penalises low-income families and those who consume significantly less than average.

Currently, consumers pay 29.11 pence per day for gas and 25.97 pence for electricity, which means, in a country with very high inflation, they pay £300 per year before they have used any energy.

Inflation remains stubbornly high in the UK. One of the reasons is historically high energy prices, which even after a price cap next month, are 60 percent higher than they were two years ago.

Many have blamed Russia’s war in Ukraine for the hike in prices. Eighteen months ago or so, with countries, which were heavily dependent on Russian energy, competing on the international spot market for a limited supply of gas to fill their reserves, prices were very high. They still are. But there is now much more diversity of supply.

Should UK standing charges be abolished?

Should the standing charge levy, which according to the Energy Networks Association, accounts for 18 percent of the average energy bill, be abolished?

David Reiner, a professor of technology policy at the University of Cambridge, says the debate as to whether standing charges should be revised has been made much more complex by politicians.

The problem he says “is that the standing charge is a political football, which has been kicked around by successive governments. Now, we have got to a stage where the government, and of course the public, think that, fundamentally, the standing charge is a problematic and regressive levy.”

Reiner, who has conducted studies into how the public perceive the energy retail market, told Gas Outlook that when researchers asked the public to break an energy bill into its constituent parts, “most people were wide of the mark when it came to estimating what percentage of the bill was profit and how much was taken by the government in taxation”. While the survey didn’t touch on standing charges, Reiner, doubts that the average person “could identify a standing charge in any shape or form.”

UK standing charge: what is in it?

So, what is included in standing charges? Professor Reiner says that network costs, which includes the cost of “maintaining the energy network and infrastructure” accounts for a large slice of the levy.

For a more detailed breakdown, a spokesman for the ENA, which represents the UK’s energy network operators said, “…Network charges help to maintain or upgrade around 600,000 miles of wires, pipes and other equipment which keep Britain’s energy flowing day in, day out. Over the next few years’ network operators are also set to mobilise £43.7 billion of investment into the UK’s energy infrastructure.”

But, curiously, infrastructure maintenance is not the greatest levy in the standing charge. Instead, says Reiner, operating costs, which include – but are not limited to – billing, collections and IT account for the largest chunk.”

Reiner believes that only when consumers “have a much better understanding of all the individual elements that constitute the standing charge”, can we get “to the heart of the issue”. The conundrum, he believes, which needs to be addressed, is how does the UK – and other nations for that matter – “separate out charging for infrastructure versus charging per unit of energy?” This question, he says, “opens the door to much bigger questions: namely, who pays the bill?”

He explains, “The quandary that governments the world over must wrestle with is: should the burden be placed on the taxpayer or the rate payer? Of course, most people fall into both categories, and so the real question for a government is, what is it trying to incentivise? The reality is that the more expensive the standing charge, the less that consumers are incentivised to reduce energy.”

Levelisation: will it work?

As you would expect, it is an issue that the Office of Gas and Electricity Markets (Ofgem), has been closely monitoring. In April it published a call for evidence on the levelisation of standing charges on energy bills. To summarise, Ofgem asked how the standing charge could be socialised across all payment methods – i.e. – standard credit, prepayment and direct debit.

While Ofgem set out five different models to illustrate charge levelisation, a spokesperson for the organisation said that its initial modelling “suggested that one payment method is always going to pay more than the other.” In other words, Ofgem confirmed that “there is no magic solution.”

The spokesperson explained, “This is at a very early stage and the trade-offs are difficult, as it involves moving costs between payment types, protecting the most vulnerable households balanced with suppliers being able to fund costs of serving different customers. There is no solution where all customers will pay less – though we are clear that any option needs to be fair and transparent for all households.”

While finding a solution that appeals to all consumers will be difficult, Professor Reiner thinks some options would be better than others. He says, “One option I would support would be for the UK government to consider raising the VAT on electricity and gas. Currently the rate is just five percent, which is effectively a huge subsidy to encourage consumption. Although politically that might be challenging, it would mean that the standing charge could be paid for by increasing VAT.”

He continues, “The other solution is to significantly reduce the standing charge, or scrap it altogether and collect the infrastructure and operational costs from increasing unit rates. That would actually encourage consumers to save more energy.”

Problems with scrapping standing charges

But, removing standing charges might lead to other inequities. Reiner, warns that “an energy retail market without standing charges could ironically lead to geographical disparities in cost.” He explains, “There could be regional difference. For instance, in Scotland, where there is lots of energy generation, the cost of energy might be cheaper than the rest of the UK. However, in a world without standing charges, consumers in Scotland would be more likely to incur more in infrastructure costs because of the longer distances and lower population density.”

He concludes, “Ultimately, government will need to make some tough decisions. Although any changes will inevitably be difficult, one advantage is that few are happy with the current situation.”

Gas Outlook contacted the Agency for the Cooperation of Energy Regulators to see how UK standing charges compare with those in Europe, but it told Gas Outlook that it “did not have any definition or data on standing charges, as it is a term used in a limited number of member states.” However, it promised that it would engage with National Regulatory Authorities to gain a more detailed understanding of standing charges in the different markets.