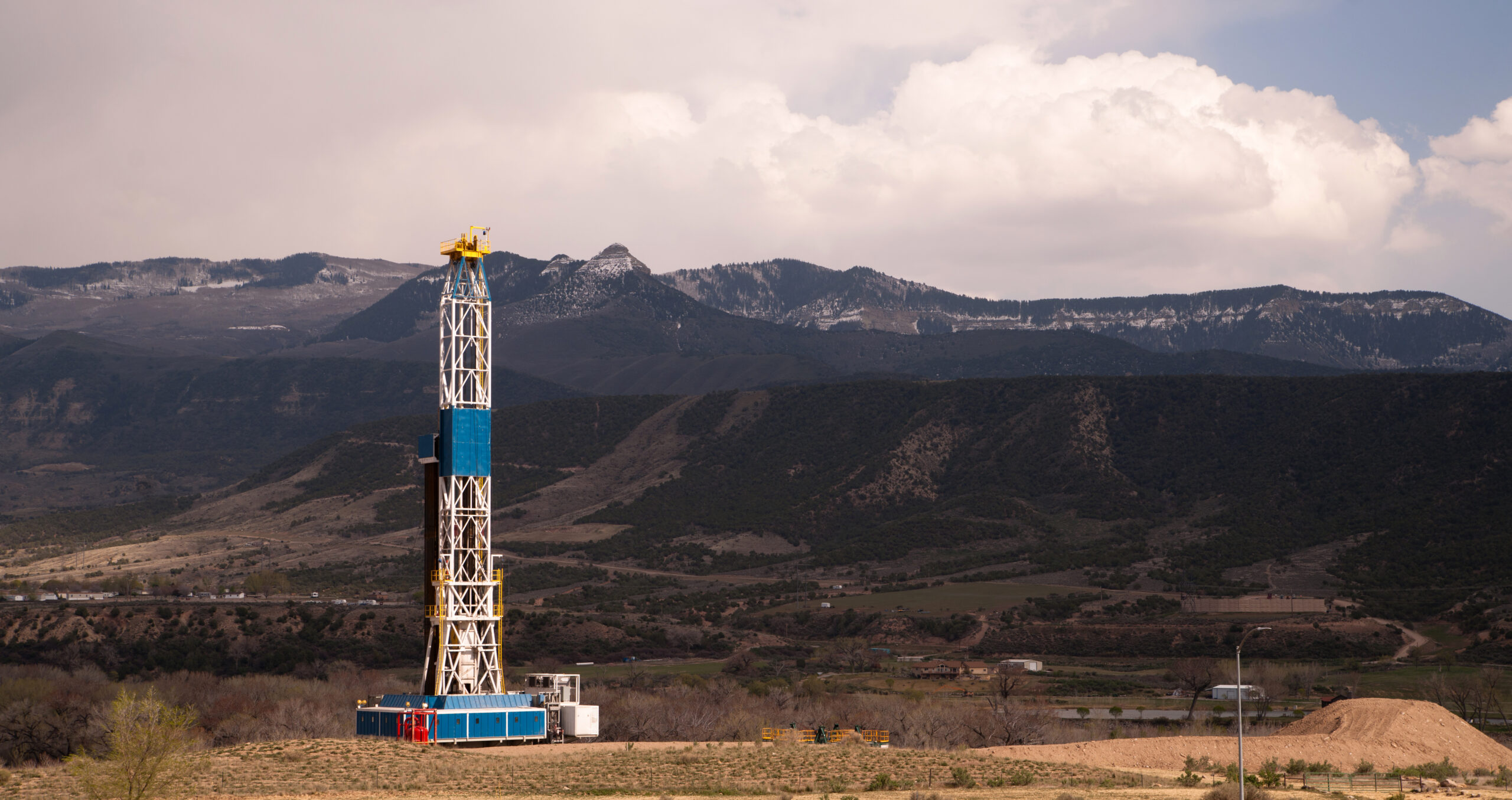

Colorado lawsuit targets abandoned oil and gas wells

A recently filed lawsuit alleges that a Colorado firm loaded up its clean-up liabilities onto another shell company that was designed to fail, saddling landowners and taxpayers with old polluting oil and gas wells.

A lawsuit filed in the U.S. state of Colorado hopes to hold an oil and gas company accountable for allegedly transferring ageing oil and gas wells to a separate entity that was designed to go bankrupt, leaving the public saddled with the clean-up costs. Those manoeuvres, the lawsuit states, amounts to a “massive fraud that is, to this day, endangering Coloradans.”

In February, the environmental law charity ClientEarth filed a class action complaint on behalf of a group of landowners in Colorado against HRM Resources. The lawsuit seeks to hold the company accountable for “unlawfully” abandoning 200 wells.

At issue is the seemingly common practice by oil and gas producers of handing off ageing wells to successively smaller entities, until ultimately those wells are abandoned and not cleaned up.

The majority of the 200 wells in question were originally transferred from Noble Energy (since acquired by Chevron) to a Denver-based company called HRM Resources.

HRM operated and profited from those wells for a period of time, before transferring them to another company called Painted Pegasus in September 2018. The problem was that Painted Pegasus filed for bankruptcy and liquidated a few years later, and the liabilities associated with cleaning up those wells were left with no owner. The state of Colorado was ultimately forced to pick up the tab — those 200 wells ended up in Colorado’s Orphaned Well Program.

ClientEarth alleges that this was all by design. “The demise of Painted Pegasus was inevitable; in fact, Painted Pegasus’ failure was the plan,” the complaint states.

The lawsuit states that HRM Resources “fraudulently transferred” those wells into a company destined to fail.

“It means that the transfer was made with an intent to defraud,” Camille Sippel, a staff attorney at ClientEarth, told Gas Outlook in an interview. “Fraudulent transfer,” she said, is a novel legal theory, one that could be replicated in many other parts of the country that are dealing with the same problems and similar industry practices surrounding the enormous crisis of orphaned oil and gas wells.

“In this context, the transfer was made with the intent to avoid the liabilities on purpose,” Sippel added.

HRM Resources did not respond to questions from Gas Outlook.

Millions of abandoned wells

There are an estimated 3.7 million abandoned oil and gas wells in the United States, and 58 percent of that total are “unplugged,” or not properly decommissioned. Unplugged wells leak methane and other toxic air pollutants such as benzene.

They are also a big source of climate pollution. In 2021, abandoned oil and gas wells leaked an estimated 295,000 tonnes of methane, equivalent to the annual emissions of 1.8 million cars, according to the U.S. Environmental Protection Agency.

The problem has grown so large because states do not impose adequate financial requirements on oil and gas companies when they want to drill a new well. At the state level, companies are typically required to post a bond, a sum that is set aside to clean up the well when its life is over. But the bonding requirements are so small, often as little as 1 or 2 percent of the total cost of clean-up.

“Our system is designed to incentivize indefinite delay of plugging oil and gas wells because the bonding is so pitifully low, that it incentivizes the oil and gas owner or producer to just walk away or transfer the wells to another company,” Ted Boettner, a senior researcher at the Ohio River Valley Institute, a Pennsylvania-based think tank, told Gas Outlook.

Plugging an old well can cost upwards of $100,000 apiece. Boettner said it tends to be vastly cheaper for the company to pay a fine for not plugging the well than to actually do proper cleanup.

A recent investigation from Pro Publica and Capital & Main found that across 15 states, accounting for nearly all of the country’s oil and gas production, the total amount of money set aside for well clean-up was just $2.7 billion, less than 2 percent of the expected $151 billion price tag. And that likely understates the true cost, the report said. Hundreds of thousands of wells do not have owners, and in many cases, regulators do not even know where the wells are located.

HRM Resource is not the only company allegedly engaging in such practices. A much larger company, at least measured by the number of wells under ownership, is an Appalachian-focused entity called Diversified Energy. Diversified operates tens of thousands of gas wells in West Virginia. Boettner likened it to Wal-Mart in that it operates a huge number of small-producing, low-margin wells; when done at such a large scale, the company can turn a sizeable profit, at least for a while.

“They’re [Diversified Energy] decent at taking wells and doubling how much they produce for a couple of years,” he said. “In some ways, it’s kind of a brilliant idea that they had. The crazy thing is that the states are sold on it.”

A class action lawsuit has been brought by Appalachian Mountain Advocates, a West Virginia-based legal NGO, against Diversified Energy. Echoing the Colorado lawsuit, the case claims that Diversified Energy took on hundreds of millions of dollars’ worth of clean-up liabilities from another gas company, and intends to eke out profits for a while, but does not have the resources or a plan to ever properly decommission tens of thousands of wells.

Boettner co-authored a 2022 report that said that Diversified Energy has a business model “built to fail.”

Diversified Energy did not respond to a request for comment.

When asked about the ClientEarth lawsuit in Colorado, Boettner said that legal challenges, if successful, may lead to some positive reforms. “These lawsuits would help stop companies from transferring their wells to dummy companies in order to avoid having to pay the decommissioning costs. These costs will have to remain on their books,” Boettner told Gas Outlook.

“That would incentivize companies to hopefully think more long-term about plugging their wells. It’s one piece of reforms that are really important,” he said. But he cautioned that it would not resolve the orphaned well crisis, which has simply grown too large. Higher bonding requirement would also be helpful, but would not address the backlog of tens of thousands of already-orphaned wells.

“The way that the oil gas system operates is that it’s predicated on companies never having to really plug their entire inventory of wells. The whole system is based on never really having to pay for those costs,” Boettner said. “That’s a massive subsidy that the public gives these companies. And it creates a business model where the polluter shifts their costs on to everybody else.”

Boettner said a tax on oil and gas production, likely paid for by bigger producers, would help fund a larger clean-up programme. He said the upside is that paying workers to plug and clean-up abandoned wells could resolve two big problems at the same time — mitigating environmental liabilities while also creating a large number of jobs in economically distressed areas. “It’s a win-win. That’s a great economic development project,” he said.

Sippel from ClientEarth said that states are beginning to wake up to the problem. Just last year, California passed a law that requires companies to put up the full cost of clean-up when they transfer an idle or low-producing well to another company. There are more than 69,000 marginally producing wells that could become orphaned in the future, according to a state estimate.

Sippel hopes the Colorado case against HRM Resources will help halt the practice of dumping liabilities onto companies designed to fail. “The idea is that the liabilities go back to the responsible parties. So, ideally, they would go back to HRM,” she said. “I think that the impact of these cases is, ideally, to sort of reframe how these liabilities should be accounted for.”