Uruguay carves dual path of hydrocarbons and hydrogen

Uruguay is the latest South American country to unveil a green hydrogen roadmap, but unlike some other aspiring producers and exporters of the emerging resource, the government has not yet relinquished plans to drill for oil and gas.

Uruguay’s green hydrogen roadmap, released in June by the Ministry of Industry, Energy and Mining, is designed to deepen the country’s energy transition by building on electricity generation that already reached an average of 97% renewable in the 2017-2020 period, including 53% wind, solar and biomass and 44% hydroelectricity.

The roadmap is open for public comment until 15 August.

For Uruguay, the next stage of transition involves decarbonising transport and industry, sectors that are particularly suited to green hydrogen and its derivatives.

Green hydrogen is sourced from water, which is electrolyzed using renewable energy to segregate the hydrogen for a variety of applications, such as heavy trucks that generally consume diesel.

In the first phase of Uruguay’s roadmap in 2022-2025, one or two small green hydrogen projects would be implemented for domestic needs such as heavy transport, long-distance buses and agricultural vehicles. In the subsequent 2026-2030 phase, medium-scale projects would be developed to produce synthetic fuels such as e-gasoline in anticipation of larger export-oriented projects to be implemented after 2030.

According to the roadmap, Uruguay has the potential to produce green hydrogen on a commercial scale at a cost of 1.2-1.4 USD/kgH2 in the western part of the country, and 1.3-1.5 USD/kgH2 near the Atlantic coast in the east. At these costs, Uruguay would be among the world’s most competitive producers, on par with Spain and just behind Australia and Algeria (1.2 USD/kgH2), Saudi Arabia (1.1 USD/kgH2) and projected cost leader Chile (1 USD/kgH2).

Offshore solutions

Among the challenges for Uruguay, whose geographic size and population of around 3.5 million are dwarfed by neighbours Brazil and Argentina, is onshore space needed to roughly double solar and wind energy capacity that would power large-scale electrolysis. The government’s proposed solution lies offshore.

Uruguay’s national oil company Ancap, which refines imported crude oil, plans to hold a tender for 10 shallow-water blocks where energy companies can conduct feasibility studies and potentially install infrastructure to produce hydrogen from renewables, most likely wind. During the 26 July Renovables Latam conference in the Uruguayan capital Montevideo, Ancap exploration and production professional Juan Tomasini said the company is open to considering a range of technologies, including offshore or onshore electrolysis. Bids are scheduled to be received in mid-2023. If successful, Uruguay’s offshore wind projects would blaze a trail in Latin America, where renewable energy developers have focused onshore up to now.

A potential drawback is cost. While the offshore component would allow Uruguay to significantly scale up its renewable energy base for green hydrogen, it would also “imply a less competitive cost of 1.7 to 1.9 USD/kgH2 by 2030,” according to the roadmap.

Nonetheless, in other respects Uruguay has some considerable advantages compared with its sometimes mercurial neighbours. The government touts stable political, economic and regulatory conditions for investors. The country has ample fresh water access, and its Atlantic coast port infrastructure would facilitate exports to the EU, which has aggressive targets to incorporate green hydrogen under a sweeping Green Deal climate strategy.

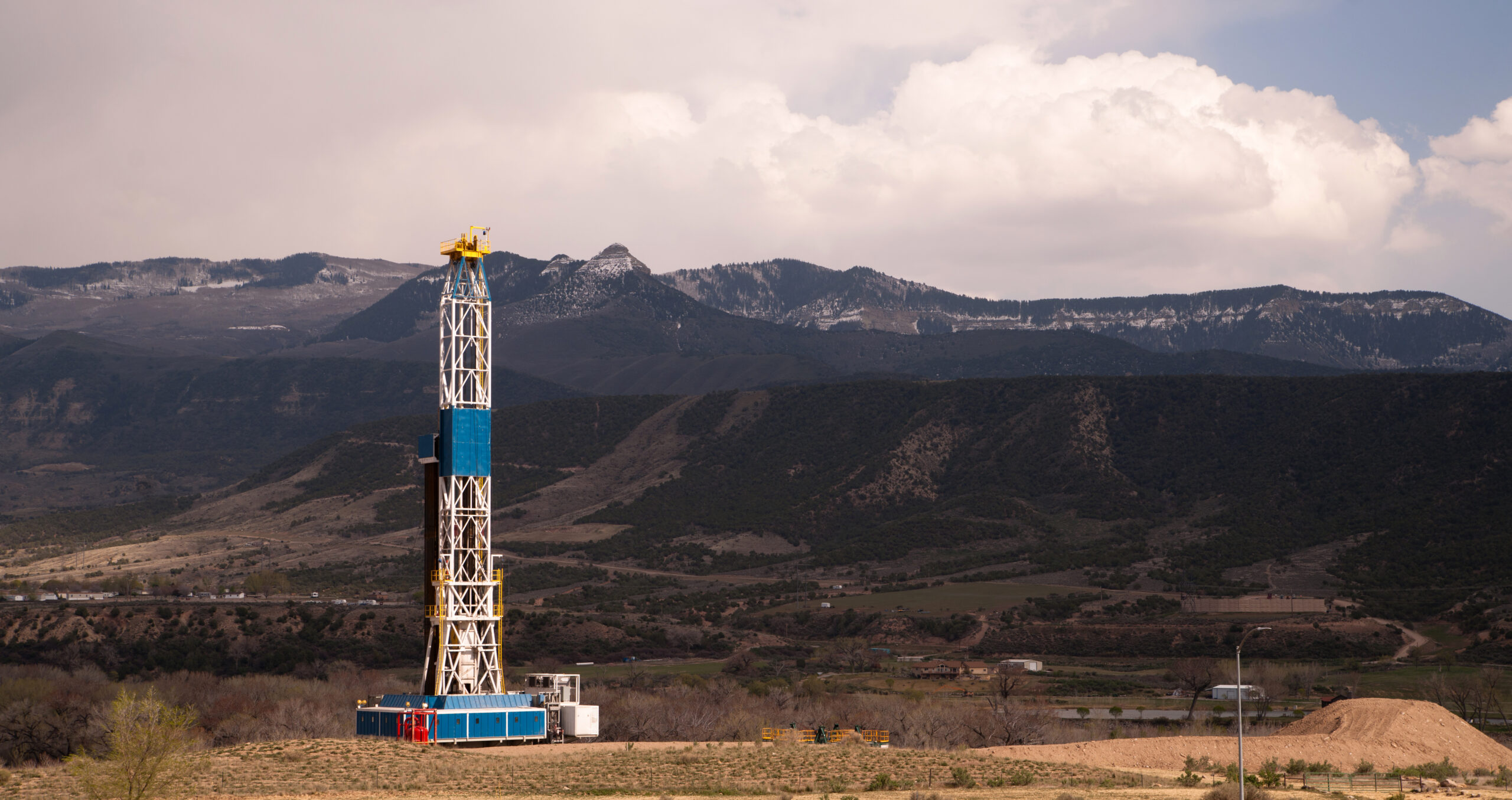

Wedded to hydrocarbons

Despite its pledge of net-zero greenhouse gas emissions by 2050, Uruguay remains wedded to fossil fuels, upstream and downstream. Speaking at the renewables conference last week, Ancap president Alejandro Stipanicic highlighted the significance of recent offshore hydrocarbon discoveries across the Atlantic in Namibia, which is considered geologically analogous to Uruguay.

In June, Ancap awarded contracts for three offshore exploration blocks: OFF-2 and OFF-7 went to Shell, while US independent APA won OFF-6. In a carryover from a 2020 upstream tender, UK independent Challenger Energy Group (CEG), signed a contract in May for the OFF-1 block. CEG says the block could hold at least one billion barrels of oil and gas, “with significant upside running room.”

Uruguay is striving to reconcile such oil industry enthusiasm with its energy transition commitments.

Speaking at last week’s congress, Stipanicic said most of the country’s energy needs are still met by fossil fuels. “We worry about the decline of the world’s reservoirs and a drop in investment,” he said. “Transition implies a period of time in which different energies co-exist and are compatible with one another.”

He noted that offshore oil and gas production and offshore wind require similar expertise. Contractual structures with companies that provide these services are similar as well.

As Uruguay’s hydrocarbon exploration plans unfold, Ancap’s counterpart in electricity, state-owned utility UTE, is making strides to decarbonise and shore up grid security. A plan to install photovoltaic solar power modules of 100 MW starting in 2026 — either directly by UTE or through tenders for power purchase agreements — is one example. Another is a near-term plan to tender for battery storage systems to complement the utility’s Valentines pilot project in central Uruguay.

If gas is ultimately discovered off Uruguay, there is also potential to produce “blue” hydrogen through CO2 capture. Speaking at a 27 July congress of the Uruguayan chapter of the World Energy Council, WEC director of policy and markets Olulana Nwosu warned against “colour prejudice” of hydrogen. “Low-carbon hydrogen will play a significant role in energy transition around the world.”